How could a man who once dazzled audiences with his home-flipping prowess on HGTV end up in court for real estate fraud? The answer lies in the complex web of deceit spun by Charles Todd Hill, a name that became synonymous with Silicon Valley's booming housing market. A bold statement: This is not just another tale of greed but an intricate narrative of how trust was betrayed and lives were impacted by one man's insatiable appetite for wealth.

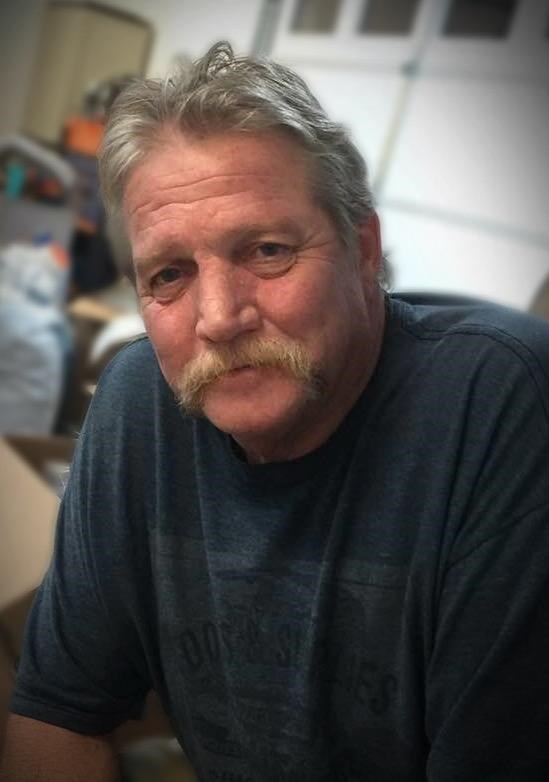

Charles Todd Hill, known to many as Mr. Flip It from HGTV's Flip It to Win It, recently faced justice after being sentenced to four years in prison. The Los Gatos resident, once celebrated for his ability to transform properties into dream homes, was ordered to repay nearly $10 million to victims affected by his fraudulent schemes. His crimes involved manipulating 18 properties across Silicon Valley, leaving behind a trail of devastation among those he swindled. At 58 years old, Hill’s fall from grace serves as a stark reminder of the dangers lurking beneath the surface of seemingly legitimate business ventures.

| Full Name | Charles Todd Hill |

|---|---|

| Date of Birth | January 1, 1965 |

| Place of Birth | Enfield, Nova Scotia |

| Residence | Los Gatos, California |

| Career | Real Estate Investor, Television Personality |

| Notable Work | Star of HGTV's Flip It to Win It |

| Legal Status | Served four-year sentence for real estate fraud |

| Restitution Ordered | $9.7 million |

| Reference | Santa Cruz Sentinel |

Hill’s journey from television fame to incarceration began when authorities uncovered a pattern of fraudulent transactions involving properties he purchased, renovated, and sold. Investigators found that Hill had misrepresented property values, falsified loan applications, and concealed critical information from buyers and lenders. These actions resulted in significant financial losses for multiple individuals, including unsuspecting investors and homebuyers who trusted his reputation as a seasoned professional.

The impact of Hill’s actions extended beyond monetary damages; it shattered the dreams of families seeking stable housing in one of America’s most competitive markets. For instance, several victims reported losing their life savings after purchasing homes at inflated prices based on Hill’s deceptive practices. Others described how they struggled to maintain ownership due to undisclosed liens placed on the properties during Hill’s tenure. Such revelations painted a grim picture of exploitation masked under the guise of entrepreneurship.

In addition to personal losses suffered by victims, Hill’s case highlighted broader issues within the real estate industry. Experts pointed out that lax oversight and inadequate regulations enabled such scams to flourish unchecked. They argued for stricter measures to prevent similar incidents in the future, emphasizing transparency throughout all stages of property transactions. While some reforms have since been implemented locally, critics remain skeptical about whether these changes will suffice nationwide.

Despite his legal troubles, Hill remains a fascinating figure whose story continues to captivate observers interested in both reality TV drama and white-collar crime. Before his downfall, he cultivated an image as a charismatic leader capable of turning dilapidated structures into luxurious abodes worthy of magazine covers. Fans admired his knack for identifying hidden potential in overlooked neighborhoods while adhering to tight budgets—a skill set that earned him widespread acclaim during his time on HGTV.

However, beneath this polished exterior lay darker truths waiting to emerge. As investigations unfolded, details emerged regarding Hill’s elaborate scheme designed to siphon funds from unsuspecting parties. Authorities discovered evidence suggesting he used shell companies to mask illicit activities, further complicating efforts to trace illegal profits back to their source. Ultimately, forensic accountants played a crucial role in unraveling the mystery surrounding Hill’s operations, providing prosecutors with sufficient evidence needed to secure convictions against him.

Throughout proceedings leading up to sentencing, defense attorneys attempted various strategies aimed at mitigating punishment handed down upon their client. Arguments centered around claims that Hill acted out of desperation rather than malice, citing economic pressures faced by many entrepreneurs operating within volatile markets like Silicon Valley’s. Nevertheless, judges rejected these pleas, concluding instead that premeditation characterized much of Hill’s conduct over an extended period.

Beyond immediate consequences faced by Hill himself, ripple effects continue affecting stakeholders tied indirectly to his empire. Former employees now struggle finding new opportunities amidst lingering stigma attached to association with disgraced figures. Meanwhile, creditors face challenges recouping debts owed them following collapse of businesses reliant heavily upon Hill’s leadership. Collectively, these developments underscore far-reaching implications stemming from individual misconduct occurring high levels corporate hierarchies.

Looking ahead, lessons learned through examination of Hill’s case may inform future approaches addressing systemic vulnerabilities exposed therein. Advocates call for increased collaboration between government agencies tasked regulating financial services alongside private sector partners committed fostering ethical standards across industries. Simultaneously, educational initiatives promoting awareness amongst consumers regarding red flags indicative possible fraudulence gain traction communities nationwide.

As society grapples evolving challenges posed emerging technologies reshaping traditional landscapes commerce exchange value, vigilance becomes paramount ensuring integrity maintained core institutions supporting modern economies. Stories such as Hill’s serve cautionary tales reminding us importance maintaining balance pursuit success versus adherence fundamental principles guiding fair play open markets.

![10 Best Charles Todd Books ([year]) - That You Must Read!](https://www.ereads.com/wp-content/uploads/2023/01/Charles-Todd-Featured.jpg)